Are you looking for where to get instant online loans in Nigeria? Don’t worry, and this article gives you a list of where to get quick online loans without collateral in Nigeria.

Loans are requested for a variety of reasons. Certain circumstances necessitate that we seek loans not just for personal use but also for business needs. For example, a big expense or other bill settlements may occur during a period of financial trouble.

Today, several financial loan lending platforms in Nigeria provide services to individuals and enterprises at all levels. If you want quick cash, you don’t need to visit any bank or offices, and you don’t even need any paperwork or collateral. All you need is a loan app that offers this service.

However, not all of Nigeria’s loan platforms give dependable and lucrative services to their customers. The best loan services offer rapid payment, rapid loan approval, a low annual interest rate, a long repayment period, and are secure.

Not only that, the best loan apps in Nigeria should be easier to navigate, and customers should not be insulted if they cannot pay up their loans on time.

In no particular order, these articles list some of the best loan apps in Nigeria for instant online loans that offer financial lending services to individuals, established organizations, and, most crucially, the often-overlooked small and medium-sized firms (SMEs).

Read also: How to increase Fuliza limit | Ipesa loan app

Best Instant loan Apps in Nigeria at a glance

Palm Credit

Palm Credit is a reliable loan app that allows users to access loans using a virtual credit card. The amount you can borrow ranges from NGN 2,000 to NGN 100,000, depending on how often you borrow money from the platform and how quickly you pay back your loan.

Palm Credit’s interest rate ranges from 14% to 24%, which is higher than that of Carbon, with an interesting range as low as 1.75%.

When writing, the Palm Credit loan app has a rating of 4.4 and over 1 million downloads. To register on this platform, all you need to do is download the app, and you can use your phone number or Facebook account.

Once approved, you can start receiving the money in your bank account. Each time you redeem an existing debt, your loan limit rises to NGN 100,000. You also earn free credit from the platform by referring people. You should try out this app if you want to find the best loan apps in Nigeria.

Get the Palm Credit app here.

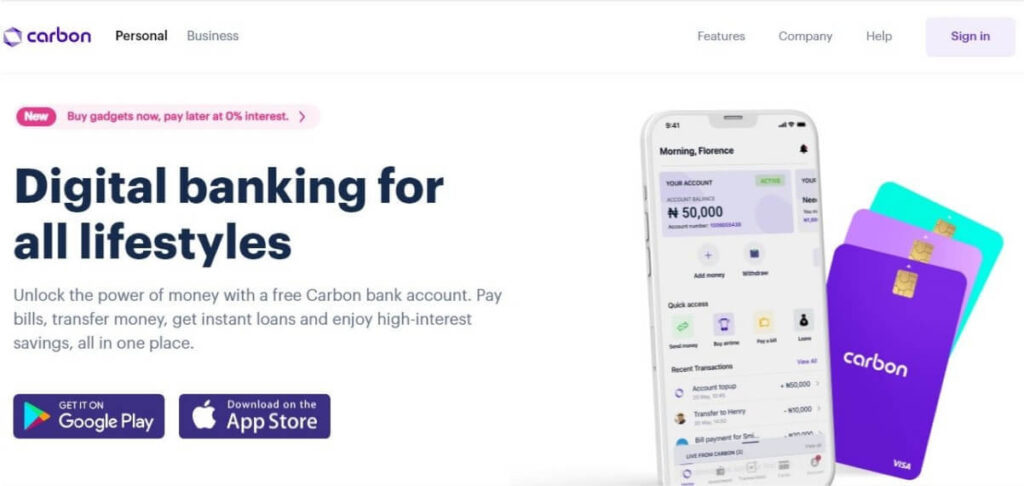

Carbon

Carbon is the second-best loan app on this list. Carbon, formerly known as PayLater, provides instant access to anyone in need of a loan, both individual and large organizations. Users or organizations in desperate need of loans can request and receive them immediately and easily.

Like many other loan companies in Nigeria, Carbon requires customers’ Bank Verification Numbers (BVN) to determine loan credit. Users can get up to NGN 20 million with an interest rate ranging from 1.75% to 30%, depending on the payback period and loan amount.

Carbon also offers airtime recharge, money transfer, and bill payment services. Carbon has a 4.4 rating on the Play Store and over 1 million downloads at the time of writing.

Download the Carbon Mobile App

Branch

The branch is another loan app that offers reliable loan lending services in Nigeria. Borrowing money via the Branch loan app is simple and may be completed in as little as 20 minutes.

Like the other loan app described here, Branch does not require collateral to obtain loans. To get a loan, all you need is your phone number or Facebook account, a bank verification number, and a bank account number.

Branch has an annual interest rate of 24%, which means its monthly interest rate is 2%. This, by far, is the best you can ever get from a loan lending platform. Unfortunately, however, the loan rate is meager.

Download the Branch App from the Google Play store and enter your personal and banking information to receive your loans. You will notice a loan offer on the dashboard; you must use this first to obtain higher offers.

At the time of writing, the Branch loan app has a rating of 4.5 on the Google Play Store and 10 million downloads, which means this app is the most widely used loan app on this list.

Get the Branch app on Google Play Store.

Migo (Kwikmoney)

The next app on our list of the best loan apps in Nigeria is Migo. First, Kwikmoney, now Migo, is a mobile loan app that offers quick and reliable loans to its users. Migo services are available in Nigeria, Brazil, and the United States.

You don’t even need a loan app to request a loan from this platform. You can request a loan from the company’s official websites and pay using available means, including bank transfers. You can also request a loan by dialing *561# on your phone and providing your bank account details and the loan you request.

If you prefer using the company’s websites, all you need to do is enter the required details; your phone number, the amount needed, and bank account details.

This platform is by far the quickest and easiest to use since you are given a USSD code to request money on any network, and you also have an online portal.

You can request the amount from NGN500 to NGN 500,000 depending on how often you borrow money and the time you repaid your last loan.

Visit the Migo official websites.

Lidya

Lidya is another outstanding and dependable loan platform in Nigeria. It was founded in 2016 with the purpose of financing emerging markets. Apart from Nigeria, it currently maintains its headquarters in the United States and operations in Portugal, Poland, and the Czech Republic.

Loans over NGN 150,000 are available to emerge businesses at a monthly interest rate of 3.5 percent. They can visit the website or download the app from their mobile phones.

To be considered for a loan from Lydia, businesses must provide their bank statements or upload their transaction history.

Visit the Lidya official website or download the Lidya App

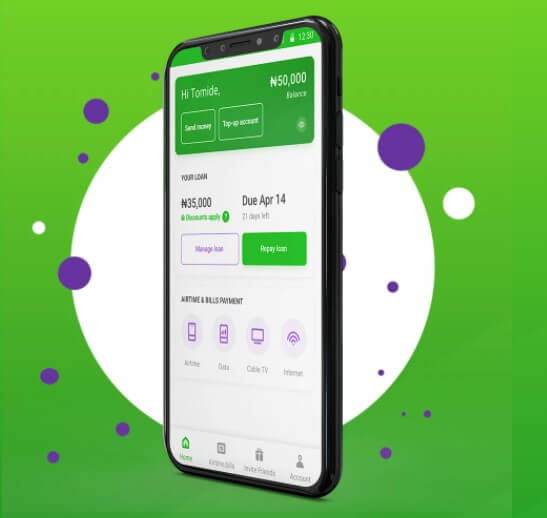

Fair Money

The FairMoney Lending app is another loan app that you may use to acquire rapid loans online in Nigeria. Because of their excellent service, this app is among our list of the best loan apps in Nigeria 2021.

You can apply for loans online with FairMoney anywhere from NGN 1,500 to as much as NGN 500,000 with no paperwork or collateral, and it is entirely stress-free to use the FairMoney Loan App to acquire loans.

FairMoney also allows you to split your payments into many installments, giving you more flexibility and making the products and services much more user-friendly. In addition, when you pay your credit card bill on time, you increase your chances of receiving additional benefits.

FairMoney’s monthly interest rate range from 2.5% to 30%, depending on the loan amount. You can also pay your bills through loans from the app.

However, you should be aware that some terms and conditions are connected, so double-check them before applying for the loan, but trust me when I say that the platform is fantastic.

Download the FairMoney loan app

Renmoney

Renmoney is another Money lending platform on our list of the best loan apps in Nigeria. This Nigeria financial loan platform focuses on supporting the growth of small-medium enterprises and micro-business.

Emerging businesses can use Renmoney to get up to NGN 6,000,000 in loans with a monthly interest rate of 2.8 percent. However, a substantial bank statement is required for companies seeking a loan from Renmoney. In addition, their transaction history should include recurring monthly revenues to demonstrate their ability to repay.

For instant loans, owners of businesses can use the Renmoney mobile app to seek loans. You can get your loan instantly by following three steps. First, download the loan app (or using the company’s portal), Register by providing necessary details about you, verify your business, then get approval.

You can use the available calculator on the company’s website to check the maximum amount you can borrow by providing all the necessary details. You will also be given the amount you will pay back weekly for those who want to pay installments.

Visit Renmoney’s official websites.

Aella Credit

The Aella Credit loan app is another reliable app where you may acquire rapid loans online in Nigeria. They offer excellent customer service, and their customer support is always available and quick to respond to inquiries. Aella credit service is currently available in Ghana, Nigeria, and the Philippines.

Users of this app, primarily employees, can borrow money anywhere from NGN 2,000 to NGN 100,000,000. However, the interest rate ranges from 6% to 20% monthly, and users must repay the loan in three months.

With the Aella credit app, there are no hassles or stresses! Download the app from the Google Play store and provide all the required information to utilize the app and access immediate loans from anywhere.

Get the Aella Credit app from Google Play Store.

Quick Check

When talking of the best loan apps in Nigeria, the list is incomplete without Quick Check. This mobile loan app is available for individuals, large enterprises, and small-business enterprises (SMEs).

Users of this app can access a quick loan of up to NGN 200,000, and the monthly interest rate is between 1% to 21%. The repayment duration time is between 15 to 91 days.

The more loans you take out and repay on time, the better your credit score will be, and you’ll be able to borrow even more money! It’s undoubtedly one of Nigeria’s top lending apps.

Get the Quick Check app from Google Play Store.

Sokoloan

The last app on our list of the best loan app is Sokoloan. This mobile loan app is easy and convenient to use. To increase your loan limit, pay your first loan on time.

With this platform, you can borrow up to NGN 100,000 with a monthly interest rate ranging from 3% to 29%. You can choose to repay your loan within 2-6 months. The more loans you take out and repay on time, the better your credit score will be, and you’ll be able to borrow even more money! It’s undoubtedly one of Nigeria’s top lending apps.

Get the Sokoloan app from the Google play store.